Solis Capital Partners is a Southern California based investment firm

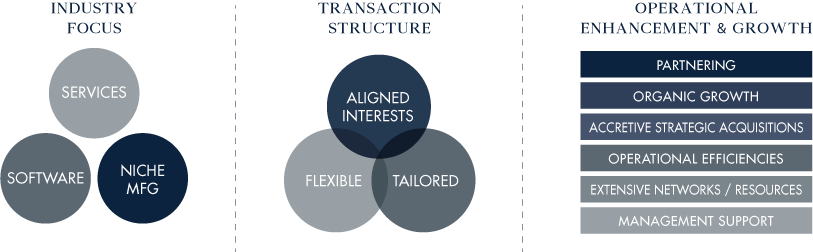

that specializes in partnering with ownership and leadership teams to build industry-leading businesses through enterprise improvement and growth. Founded in 2002, Solis typically invests $2-$25 million in companies with an established track record in software, business services, niche manufacturing, value-added distribution, and other industries.

“Solis” — the Latin word for “sun” or “of the sun” — best describes the philosophy of our firm,

which is fundamental, reliable, consistent and empowering.

SOLIS 360° INVESTING provides a template for how we partner

with owners and managers to consistently create value.

1. UNDERSTAND STAKEHOLDER INTEREST

2. IDENTIFY COMPANY’S NEEDS

3. DEVELOP TRANSACTION STRUCTURE

4. AGREE UPON GO-FORWARD VISION

5. DILIGENCE AND CLOSE

6. FINALIZE STRATEGIC PLAN

7. IMPLEMENT PLAN AND VISION

8. SUPPORT LEADERSHIP GOING FORWARD

Solis invests between $2 million and $25 million to acquire an interest in companies that have an established business, a history of success, and where Solis can be a helpful and valuable partner in realizing stakeholder and company aspirations. Solis is flexible and creative in tailoring each investment to align all interests and meet the company’s needs. Emphasis typically is on organic growth, along with strategic and accretive acquisitions where appropriate. Solis invests with a long-term view targeting a “next event” for all parties.

Preferred investments are headquartered in the United States in defensible niches with broad customer bases.

INVESTMENT CRITERIA

While each opportunity is reviewed based on its merits, Solis portfolio companies generally have most or all of the following attributes:

Strong leader or leadership team with the desire and capability to grow the business;

Proven business model with a growing, fragmented, domestic market size of at least $200 million;

Proprietary intellectual property, processes or capabilities that create barriers to entry;

Secure market position not subject to technological obsolescence;

History of positive cash flow;

Potential to generate high-single to double digit EBITDA margins;

Revenues between $5 million and $100 million;

Potential for significant growth.